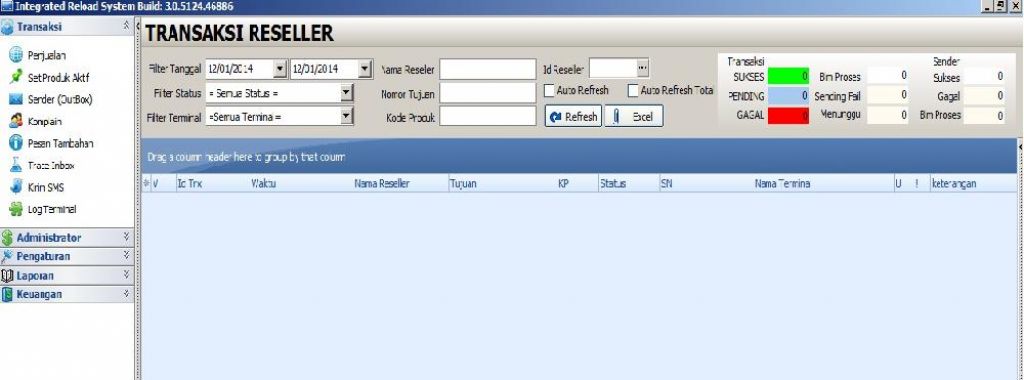

Software Pulsa Irs

Best listening experience is on Chrome, Firefox or Safari. Subscribe to Federal Drive’s daily audio interviews on. As lawmakers and tax policy experts look to revitalize the IRS Oversight Board that’s lain dormant for years, one proposal on the table would give the board the power to award bonuses to IRS executives who meet or exceed performance goals. At a recent Senate Finance Committee hearing that fielded IRS reform ideas from the private sector, the National Association of Enrolled Agents proposed giving the newly rebranded IRS Management Board, pending a bill from Sens.

Forum software pulsa irs. If this is your first visit, be sure to check out the FAQ by clicking the link above. You may have to register before you can post: click the register link above to proceed.

Ben Cardin (D-Md.) and Rob Portman (R-Ohio), the power to award taxpayer services. In an interview with Federal News Radio, Robert Kerr, the executive vice president of NAEA and a former investigator for the Senate Finance Committee, shed more light on how the bonuses would help the IRS meets its taxpayer services goals. “Some tried-and-true management theory will tell you that we need to set clear goals and we need to reward the achievement of those goals. And so if you have an agency that’s, in fact, all rowing in the same direction, there’s a reward for doing so,” Kerr said. Under this proposal, the IRS Management Board would serve as an independent third party that would determine which agency officials deserve raises. “This is something that is granted outside of the typical review that’s within the agency, so that there’s an impartiality to it — that someone else is going to make the judgment call on whether folks have made the goal, and what reward they deserve,” Kerr said. Following the passage of last year’s tax reform law, lawmakers on both parties have recognized the IRS needs more resources to meet its mission.

Since FY 2010, the IRS has had its budget reduced by 20 percent, when adjusted for inflation. For some Republican members of Congress, the IRS Management Board might also help guarantee that an increased agency budget gets spending appropriately. Download free common clinical cases a guide to internship pdf. “IRS is the one federal agency that touches most Americans, and I think Congress wants some assurance that the agency is, in fact, performing well. I also think that it’s a great balance when it comes to providing with funds.

There’s been a lot of talk for many years that we’re not funding the agency appropriately. I think there’s been resistance on the Hill because there’s a trust deficit as to whether IRS is able to manage more money well,” Kerr said. “So if we have a management board in place, with the right people on it, then it can assure Congress that IRS is, in fact, executing to its plan and executing well.” In recent years, the IRS has been adjusting its workforce through attrition.